Trump Accounts Explained: How to Open One & Get the $1,000 Federal Deposit

New details explain how to open an account, who qualifies & how much money children may receive to start saving.

In This Article

Trump Accounts are a new type of federally backed investment account created to help you save for your child’s future. The money can be used down the road for big milestones, like education or buying a home.

Originally, the program focused on babies born during Trump’s second term. But with new updates (including major private donations), the scope has expanded beyond newborns to include all children up to age 18. The amount your child is eligible for depends on their age and, in some cases, where you live.

Below, we break down who qualifies, how to open an account (there’s a new form), what your child might get, and what these accounts could mean for your child’s financial future.

Ready to start your registry?

We make it easier to know what to add—and when

What Are the Trump Accounts?

Trump Accounts are federally sponsored investment accounts created to help American children under 18 build long-term financial security. Families can contribute to these accounts at any time—much like a savings or retirement account—with the goal of giving kids a stronger financial foundation as they grow up. Parents can make contributions themselves, and employers can contribute as well, offering multiple ways to help boost a child’s future savings.

The program was first introduced with the passage of the One Big Beautiful Bill Act in July 2025. Under the original legislation, eligible newborns receive a one-time $1,000 seed contribution from the U.S. Treasury to start their account.

How to Open a Trump Account

You will be able to open a Trump Account as soon as the current tax season with a newly-created form, even though the seed contributions will happen later this year.

Here are the steps you can take to open an account:

Step 1: Fill out IRS form 4547

Parents will use this new tax form to:

Enroll their child in a Trump Account and receive the $1,000 seed contribution

Open a Trump account for any eligible child under the age of 18

Add contributions to the Trump account

When can you file the form?

There are a few different options regarding when you can file, including:

When you file your 2025 tax return using Form 4547

Online via a portal at trumpaccounts.gov that will be open by summer 2026

Anytime after the program officially launches

Step 2: Wait for Treasury instructions

According to the Trump Accounts website, after you file the form with your taxes, a financial institution will receive the funds and activate an account. The $1,000 seed deposit (if elected) starts after July 5, 2026, and other contributions can follow.

Who Qualifies For the Free Seed Money?

All children under the age of 18 are eligible to open a Trump Account—the difference is in whether they’ll get free seed money from the government. When the program was first announced, it was limited to those born between a certain time, but in December 2025, the president announced that older children may be able to receive a deposit, too.

Who’s Eligible for the $1,000 Newborn Contribution

Your child qualifies for the full federal $1,000 contribution if they:

Were born between January 1, 2025, and December 31, 2028

Are a U.S. citizen

Have a Social Security number

Your child does not need to meet any additional income requirements to be eligible, as long as they are born between the specified dates.

Additional Contributions

In addition to the federal $1,000 seed contribution for eligible newborns, children with Trump Accounts may also receive funding from philanthropists, their home state, employers, and private companies, significantly increasing the amount some children start with.

Private and Philanthropic Contributions

Private companies and philanthropists have also pledged contributions to the Trump accounts.

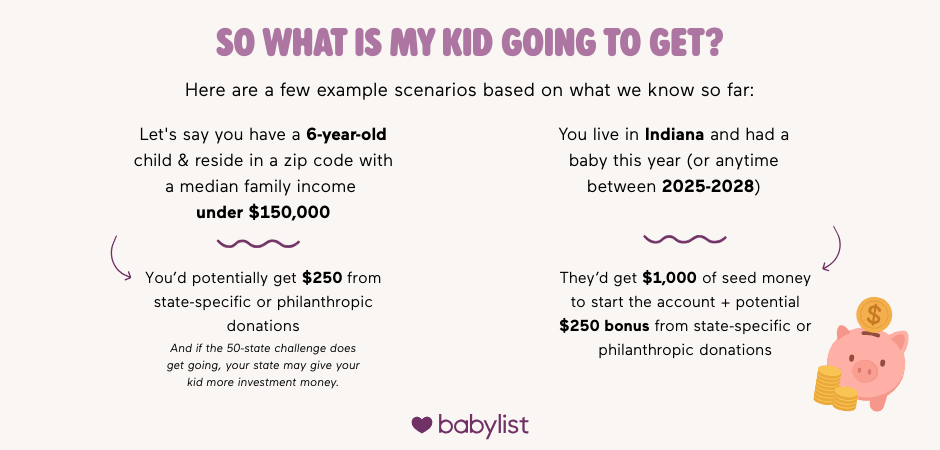

Philanthropists Michael and Susan Dell have pledged $6.2 billion to give qualifying children a $250 contribution. Eligible children will be those under 10 (not just those born from 2025-2028) and those who reside in ZIP codes with a median family income of $150,000 or less.

The CEO of Visa, Ryan McInerney, announced Visa’s plan to launch a new platform allowing families to direct their credit card rewards into Trump Accounts, creating another way for parents to add funds over time. More details on how this platform will work are expected later in 2026.

State-Specific Contributions

Additional state-level commitments were announced or teased during the January 2026 Trump Account Summit, with Treasury Secretary Scott Bessent describing the effort as a growing “50-State Challenge” aimed at encouraging more donors nationwide. The following states have announced an additional commitment above the $1,000 federal contribution.

Connecticut. Ray and Barbara Dalio announced plans to fund Trump Accounts for eligible children in Connecticut, effectively doubling the Dell contribution for qualifying kids in that state.

Indiana. Investor and philanthropist Brad Gerstner announced a commitment to contribute $250 to Trump Accounts for children under age five in Indiana, with additional matching contributions expected.

Texas. State leaders announced plans to contribute an additional $1,000 to Trump Accounts for children born in Texas, effectively doubling the federal seed contribution for eligible newborns in the state.

More state-level announcements are expected in the coming months as part of the ongoing 50-State Challenge.

Employer Contributions and Corporate Matches

Employers can also play a role in investing in these accounts. Under current guidance, companies can contribute up to $2,500 per year to an employee’s child’s Trump Account—and these contributions do not count as taxable income for the employee.

Several large companies have already announced plans to participate or match contributions, including Uber, BlackRock, Visa, MasterCard, IBM, Broadcom, Intel, Nvidia, Comcast, Coinbase and others. For example, IBM announced it will match the federal $1,000 deposit for eligible newborns of U.S. employees and offer additional matching incentives when parents contribute.

Treasury officials and business leaders at the summit emphasized that employer participation is expected to expand, positioning Trump Account contributions as a new family-friendly workplace benefit.

We’ll continue updating this section as new commitments are finalized and official guidance is released.

How Trump Accounts Work

Once opened, Trump Accounts function like long-term investment accounts. Parents (and also employers, family and friends and charities) can contribute money each year, and the funds grow over time—similar to a retirement account, but with some added flexibility. Here’s what you can expect:

How much money do kids start with?

Newborns: Eligible babies receive a $1,000 seed contribution from the U.S. Treasury.

Older children (under age 10): Eligible kids receive a $250 contribution, thanks to the Dell family’s expansion gift, as long as they meet location criteria (see above). Depending on your state's involvement, your child may also be eligible for a state-level contribution.

Children under 18 who don’t qualify for either seed: Their account will start at $0, but parents, caregivers and employers can still make contributions at any time to help build savings for the future.

How much can you contribute each year?

Parents and caregivers can contribute up to $5,000 in after-tax dollars annually.

Employers can contribute up to $2,500 per year, and these contributions don’t count as taxable income for the employee.

Certain governmental entities and charities may also make contributions, according to the IRS. More details on how these contributions will work are expected as Treasury guidance continues to roll out.

How is the account taxed?

Money inside a Trump Account grows tax-deferred, meaning you don’t pay taxes on investment growth each year.

Taxes apply later when the money is withdrawn—similar to how traditional IRAs work.

When can kids use the money?

Children who have Trump Accounts can access the money starting at 18—though certain tax rules apply. Ryan Graves, chartered financial analyst and president at Bemiston Asset Management, explains it simply: “After age 18, consider it a ‘traditional IRA’—taxed when you pull pre-tax money, plus a 10 percent penalty before 59½ unless an exception applies.”

Here’s what that means in practice:

Before age 18 👉 Withdrawals generally aren’t allowed, with the exception of an ABLE rollover at age 17 for eligible individuals with disabilities.

After age 18 👉 The account works much like a traditional IRA:

Withdrawals are taxed as income.

Taking money out before age 59½ usually triggers a 10% penalty—unless the funds are used for certain qualified expenses.

What can you use the money for?

Trump Account funds can be used for a range of qualified expenses without triggering the 10% penalty, including:

Higher education expenses

A first-time home purchase (up to $10,000)

Starting a business (up to certain limits)

The birth or adoption of a child (up to certain limits)

These rules are designed to help kids—and eventually adults—use the money for major life milestones.

How does a Trump Account compare to traditional retirement accounts?

Roth IRAs and traditional IRAs are both retirement accounts designed to help adults save for the future. They come with specific tax benefits and rules around when the money can be used.

Trump Accounts aren’t retirement accounts, but after age 18 they follow rules that are similar to a traditional IRA—especially when it comes to taxes and penalties.

The big difference: Trump Accounts are designed to help kids build long-term savings starting early in life (without needing employment income).

What the Investment Might Look Like in the Future

There’s a wide range of possible outcomes, because investment growth depends on how much is contributed over time and how the market performs. But the potential long-term impact is significant.

“Starting an account early creates long-term financial stability and eases the stress of rising parenting expenses,” says Tansley Stearns, president and CEO of Community Financial Credit Union. “Accounts with external contributions make it easier to build savings with less out-of-pocket strain.”

To give you a sense of what’s possible, Newsweek shared a couple of examples based on a 7% average annual return:

If a family contributes the maximum $5,000 each year (on top of the initial seed money), the account could grow to about $6.95 million (pre-tax) by the time the child reaches age 65.

If no additional contributions are made and only the initial deposit is left to grow, the account could still reach approximately $93,000 by age 65.

These aren’t guarantees—just illustrations of how powerful long-term investing can be, especially when an account is started early.

What This Really Means for Families

It’s easy to see numbers like $6.95 million or $93,000 and feel…a little stunned. But here’s the real takeaway:

1. Starting early matters more than contributing a lot. Even the smallest seed contribution can grow significantly over decades—especially when it’s invested from birth or early childhood. As Setu Shah, founder and CEO of Financial Doula, explains, “Newborn investment accounts build a financial safeguard for children, [allowing them] to financially benefit from compound growth due to investment into the stock market. There is a lot of evidence that even a slight financial headstart can help many children overcome socio economic barriers in the future.”

2. You don’t have to contribute the max every year. Most families won’t put in $5,000 annually, and that’s okay. Even occasional contributions can compound meaningfully over time.

3. The account isn’t meant to cover baby expenses right now. Trump Accounts are designed for long-term financial support—think:

Education

First-home savings

Emergencies

Retirement

4. Market ups and downs are normal. The balances will rise and fall, but long-term investing historically trends upward.

5. This won’t replace a 529 or a savings account. It’s another tool in a family’s financial toolkit—not an all-in-one solution. It complements (not competes with) education-focused accounts like 529s.

Upsides and Downsides of the Trump Accounts

Here’s a quick breakdown to help you see the big picture:

⭐ Upsides

Free seed money for eligible children.

Tax-deferred growth, which means no yearly taxes on earnings like capital gains or dividends.

Helps build a long-term financial foundation as your child enters adulthood.

Flexible contributions: parents can add up to $5,000 each year, and employers can add up to $2,500.

No earned income required, unlike Roth or traditional IRAs—kids don’t need a job to contribute.

💡 Downsides

You can’t use the money now.

Limited access to the money before age 59½, unless the withdrawal meets certain exceptions (more guidance to come).

Market risk: the value of the account will rise and fall with the stock market.

Less effective for education savings compared to 529 plans, which:

Allow tax-free withdrawals for qualified education expenses

Permit up to $35,000 to be rolled over to a Roth IRA

Offer more flexible use for school-related costs

Build your registry with confidence

We make it easier to know what to add—and whenFinancial Literacy Terms To Know

Financial terms can be confusing, especially for busy parents and caregivers who don’t have time to decode financial jargon. That said, we've put together a short list of some terms that will be helpful for you to know as you think about the Trump accounts and planning for the financial future of your family.

Tax-deferred: Some accounts let your investments grow without paying taxes each year; you only pay taxes when you withdraw the funds. This includes no yearly capital gains or dividend taxes. "You’re not filing or paying tax on the account’s growth annually; instead taxes show up later, when the beneficiary withdraws the pre-tax portion (or if they convert, depending on future guidance)," says Graves. "That deferral lets compounding work faster than in a taxable brokerage account where you pay some yearly tax."

Roth IRA: A retirement account where contributions are actively taxed, but withdrawals are not. This means that when the money is withdrawn after 59 ½ years old you won't have to pay taxes on it. Money can be withdrawn from a Roth IRA for certain things like buying a first time home or for certain medical expenses. In a traditional IRA, withdrawals are taxed as income but you receive immediate tax benefits on your contributions.

Qualified withdrawal: A qualified withdrawal typically refers to money withdrawn from a retirement account that meets certain criteria such as age of the account holder, the length of time the account has been open, and the reason for the withdrawal.

Contribution limit: The maximum amount of money you can put in an account per year.

Seed contribution: The initial amount of money deposited into an investment or savings account to start it.

Expert Sources

Babylist uses high-quality subject matter experts to provide accurate and reliable information to our users. Sources for this story include:

Setu Shah, founder and CEO of Financial Doula.

Tansley Stearns, president and CEO of Community Financial Credit Union.