The Cost of Raising a Baby in the US Has Risen to New Heights

The latest data shows a 25 percent jump—plus, certain states are much more expensive for child rearing.

In This Article

Picture this: your pregnancy test just came back positive, and along with all the joy and daydreaming, the reality has set in: you’re having a baby. Raising a child can be one of the most rewarding things in life, but we won’t lie—it can also be very expensive.

And right now, with inflation, the cost of food rising and tariffs impacting a wide variety of imported baby essentials, parents are seeing prices rise as much as 20–30 percent on strollers, car seats, monitors and other major gear, making parenthood even more costly than ever.

That's why it's important to consider how much money you’ll spend on raising a child (during the first 18 years, at least). And if this is making you realize it's time to create a budget, we've got you there, too.

To help you get a better picture of how much it costs to raise a baby in the United States, we’ve pulled some of LendingTree’s most recent data and tapped financial experts for their insights on what to expect and how to best prepare for this next step in your life.

The total cost of raising a child, per year and from birth to age 18

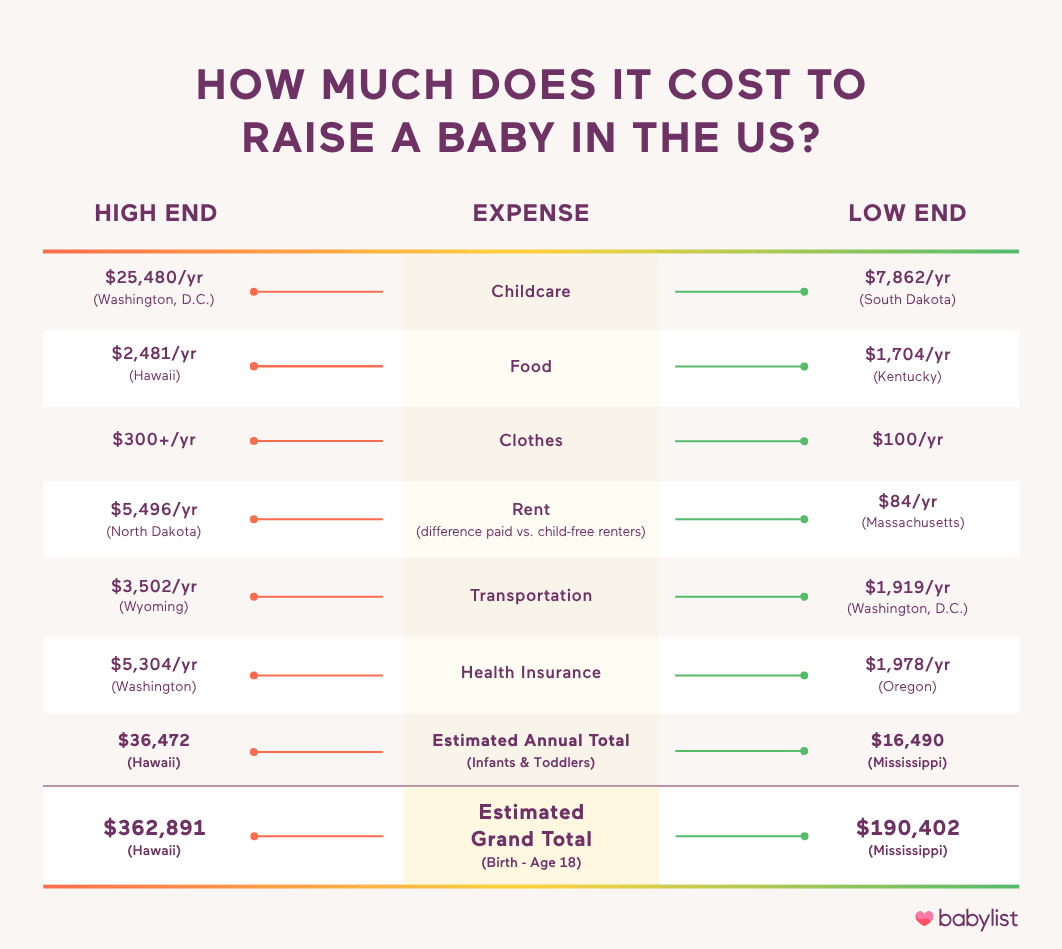

The total cost of raising a child will vary based on where you live across the United States and the resources you currently have access to. According to LendingTree, the average annual expenses required to raise a small child (minus tax exemptions or credits) totaled $29,419 in 2025—a nearly 36% percent jump from $21,681 in just two years.

From the day your baby is born (including the cost of giving birth), the experts at LendingTree found that families are projected to spend $297,674 over 18 years to raise a child, averaged across all 50 states. This 18-year estimate was lowest in Mississippi at $190,402. And the highest? Hawaii residents average $362,891 in child-related spending.

And keep in mind that this study doesn’t include costs like college tuition or adoption or fertility costs, says Kendall Meade, certified financial planner at SoFi.

Breakdown of expenses

The LendingTree data took into consideration the cost of childcare, food, clothes, rent, transportation, health insurance premiums and state tax and exemption credits to determine how much it costs to raise a child in the US by state.

Childcare

Childcare is without a doubt the most expensive part to consider when raising a baby in the US.

Although Hawaii takes the cake in terms of being the most expensive place to raise a baby in the US, it actually isn’t the highest child care. According to LendingTree, Washington, D.C. has the highest child care costs at an average of $25,480 per year. Other close contenders include Massachusetts, Hawaii, Washington state and Minnesota.

“From the moment a baby is born until they begin preschool as a toddler, parents can expect the cost of childcare to be at the top of the list, especially when choosing options that may include a nanny, babysitter or daycare,” says Natalia Brown, chief compliance and consumer affairs officer for National Debt Relief. Even if you’re able to lower your childcare costs through things like nanny shares or co-op daycares, it’s still a large part of the pie for the first several years.

But you won’t be paying for childcare forever. “Once school begins, the costs associated with childcare may change,” Brown says. “For instance, choosing to enroll a child in public or private school.” It’s not a decision you’ll need to make immediately, but definitely something to consider as your little one gets closer to preschool age. The costs related to private or charter school tuition will vary based on the institution, while public school and homeschooling are guaranteed to be lower-cost options (and even completely free in some cases, if you qualify for financial assistance).

Food

Babies need to eat, and that can be expensive—whether you’re buying baby formula, stocking up on pumping supplies or keeping up a rotation of nursing accessories, the price can add up. Then at around six months old, your baby will start on solid food. You can count on restocking your fridge and pantry on a weekly basis, and the cost of an extra mouth to feed can really add up between the prices of fruits, vegetables, baby food and other pantry staples.

Across the US, the highest food costs are in Hawaii, Washington D.C., Alaska, Massachusetts and Vermont. And if you live in a more metropolitan area, your food costs are going to be higher there as well.

Clothes

Aside from food and shelter, you need to make sure your baby is appropriately dressed. Although LendingTree’s data estimates the highest prices of clothing at $278 per year (the most expensive state for this category being California), don’t be surprised if you end up spending closer to $300 per year regardless of where you live—and even that is an extremely “optimistic” number, says David Johnston, certified financial planner and managing partner of Amwell Ridge Wealth Management.

One way to save money is by buying clothes that will last through multiple kids. Some of the best baby clothing brands will stretch over a few growth stages and will still look great even as hand-me-downs.

Rent

If you add a member to the family, then you might need to upgrade to a larger space—which is likely to raise your total rent. According to the data, North Dakota has the most expensive average rental prices, with families paying $5,496 more in rent per year than child-free individuals.

You might luck out if you live in the South, because that’s where the least expensive states to raise a child are—Mississippi, South Carolina, Alabama and Arkansas. That said, parents in these states will still pay anywhere from $500 to $2,000 more in rent each year when they add a child to the picture.

Transportation

The cost of transportation is another factor to take into consideration when raising a baby. This calls for the purchase of not only a car seat (or even multiple car seats, depending on how many vehicles you have and if you opt for a new car seat for every stage versus going with an all-in-one car seat from the beginning), but potentially extra plane tickets for cross-country and international travel. LendingTree’s data shows that Wyoming has the highest annual transportation costs at $3,502.

States that fall lower in this category include Washington D.C., New York and Florida.

Health Insurance Premiums

A new addition to the family will also include an increase in your health insurance plan, as another dependent now needs coverage. Compared to LendingTree's 2023 study, health insurance premiums have increased on average by over $1,000, regardless of where you live. In 2025, Oregon has the lowest health insurance premium cost at $1,978 per year. Their West Coast neighbors Washington and California are on the high end, averaging an additional $5,304 and $5,056 to families' annual premiums, respectively.

How expenses might change as your child grows

As your little one grows up, how you spend your money on them will change to keep up with their growing mind and body. And especially going into the teenage years, there are additional expenses to keep in mind.

“Parents can expect an increase in their child’s needs and interests as they begin to participate in extracurricular activities or sports—even being part of a sports team at school comes with costs for uniforms, equipment and travel to games,” Brown says. “Additional costs, especially when raising a teenager, may include providing them with a cellphone, giving them an allowance or budget for when they hang out with friends and adding them to the car insurance plan when they start driving. Of course, we can’t forget the birthday gifts either.”

And even though college may seem like a long way off, it’s a good idea to start considering the costs of higher education—it’s never too early to start saving!

Making your money go further

State Tax Exemptions/Credits

You may be in luck if you live in a state that provides tax exemptions or credits to those with children. California’s Young Child Tax Credit, for instance, provides up to $1,154 per year to low-income families, making it one of the highest state child tax credits in the US. Other states with a hefty tax credit include Minnesota, Colorado, New Jersey, Oregon, Utah and Vermont.

On the other hand, some states don’t offer any kind of child-related tax credit, including Washington, Connecticut, Alaska, Nevada and New Hampshire, to name a few.

If your state doesn’t offer any financial assistance, or if you don’t qualify for income-based assistance, our financial experts have a couple other recommendations for ways you can save some money for your child (and for yourself).

Open a Dependent Care Flexible Spending Account

Childcare can be a huge expense, but some jobs offer benefits that can help. The financial experts we talked to all recommend opening up a Dependent Care Flexible Spending Account, as it’s a great way to lower your annual tax bill while paying out-of-pocket child care related expenses.

“If your job offers a dependent care flexible spending account, this can allow you to use pre-tax dollars to pay for eligible dependent care expenses,” Meade says. “The contribution limit for 2025 is $5,000, which is likely less than what your true costs are, but (depending on your tax bracket) that could save you over a thousand dollars on taxes.”

Consider a 529 Plan

If saving for college is a goal, a 529 plan can be a great tool. “529 plans grow tax-deferred, and withdrawals are tax-free if they're used for qualified education expenses,” says Meade.

“Opening and annually funding a 529 education savings plan is a great way to save for future education expenses,” says Vincent Birardi, a wealth advisor at Halbert Hargrove. “Plus, in many states, you may qualify for a tax writeoff if you participate in your state’s sponsored 529 plan.”

Also worth looking into is Trump accounts, investment accounts opened for every newborn baby in the U.S.

At the end of the day, there’s no doubt that kids are expensive. That said, with the money being spent, you’re actually investing in building a life and sharing memories with people you love, which is worth the cost if you ask us.