Best Gifts to Set Up a Child's Financial Future

These are the gifts that literally keep on giving.

In This Article

Your grandchild's first words may not be, "Help me set up a Roth IRA, Nana," but that doesn't mean they wouldn't benefit from one. Helping kids prepare for their financial future is one of the best gifts you can give them, whether that means opening a savings account, looking into a 529 plan for college or simply buying a piggy bank so they can gather loose change.

The holiday season is the perfect time to pass along a financial gift, even if kids don’t totally see the value yet (maybe pair it with a small stocking stuffer, since toddlers aren't well known for their understanding of savings bonds). They also are meaningful gifts for newborns or for baby's first holiday season. Plus, many parents appreciate a gift for their kid that's not a toy.

Here are a few financial gifts for babies (and older kids!) to help kick start their future financial success:

Money Gifts for Kids

Sure, you can slide some cash into a holiday card here or there, but why not invest that occasional $20 into something that will accrue interest? There are plenty of options that will have your money—no matter how small that starting amount may be—working for you, rather than just getting dusty. And no, it's not too soon to start saving for their retirement!

Create a cash fund via Babylist.

Use EarlyBird to start an investment account.

Open a savings account.

Look into fixed savings bonds.

Start investing with Stockpile.

Seed a Roth IRA for their retirement.

Custodial Accounts

If you'd rather just transfer or gift assets (money, real estate, stock, etc.) to a child, there are options that will streamline that process while helping minors avoid the burden of heavy taxes.

Set up an account under the UTMA (Uniform Transfers to Minors Act) or UGMA (Uniform Gift to Minors Act) to transfer or gift assets.

Create a trust fund.

How to Pay For College For Kids

College is getting more expensive with every passing year. Who knows how much tuition could be in 18 years? Start saving now with gift cards, a 529 plan or an ESA.

Get a Gift of College gift card.

Start a 529 plan (aka "qualified tuition plan") with companies like Hadley or Ugift.

Establish a Coverdell Education Savings Account (ESA).

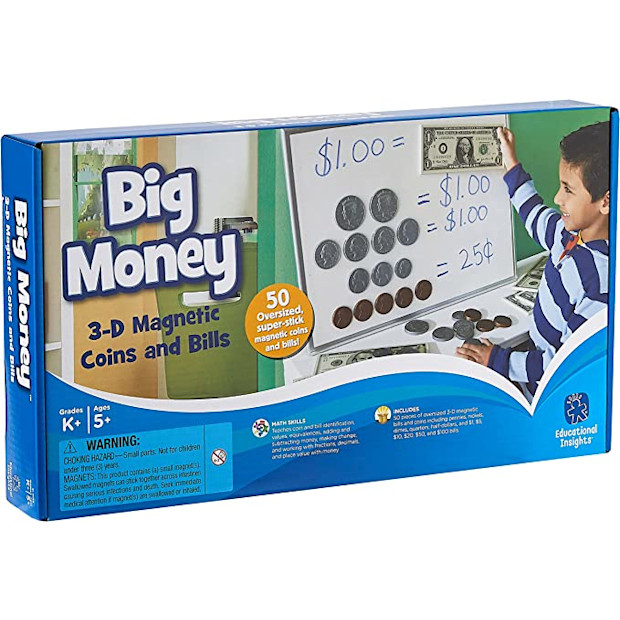

Toys That Teach Kids About Money

Teaching kids financial literacy may not sound as fun as a trip to Disneyland, but setting them up with knowledge is much more valuable in the long run!